The Digital Transformation in Banking Industries

Abstract

The world is changing, and so is banking, as well as the way it is perceived by the customers. Digital banking has become an irresistible business trend. McKinsey research in personal financial services shows that Asian consumers are becoming more and more comfortable with using mobile and Internet channels for banking services, with their use increasing on average more than 35 percent in the past three years (McKinsey and Company, 2015).

Today’s young professionals will be significant drivers of retail banking revenues tomorrow. McKinsey analyzes that several shifts in consumer behavior signalling that the time of the premier digital bank is approaching are increasing digital usage across Asia, channel-preference shift, multi channel consumer decision journey, and digital sales.

Delivering advice in a way that naturally fits within people’s patterns of behavior is a sweet spot for all financial institutions including banking industries. A digital initiative in a form of mobile application needs to be developed in order to pursue bank’s focused strategy to grow into the leading bank in Indonesia.

In order to adopt new propositions for its digital bank serving its savviest, digital-friendly customer segments, a bank serving agri business needs subject matter experts for assessing current digital saving bank concept including market research assistance.

The Challenge

Based on the latest condition in urban area especially in Jakarta, the digital bank will be mainly targeting individual customers between 20-40 years old who earn stable income through employment or run their own business in Jakarta. We have to take into account the major changes digitalization will have on this society in the future. It has to calculate the consequences of the ever growing importance of social media in any service related business. It has to strike a balance between the growing need for security and privacy matters on the one hand, and for digital banking in all its forms on the other. But above all, it is expected to build a bank for a more self conscious, e-savvy customer who had lost confidence in traditional banks.

Being digital requires being open to reexamining the bank entire way of doing business and understanding where the new frontiers of value are. At the same time, being digital means being closely attuned to how customer decision journeys are evolving in the broadest sense. That means understanding how customer behaviors and expectations are developing inside and outside the bank, as well as outside the banking industry, which is crucial to getting ahead of trends that can deliver or destroy value.

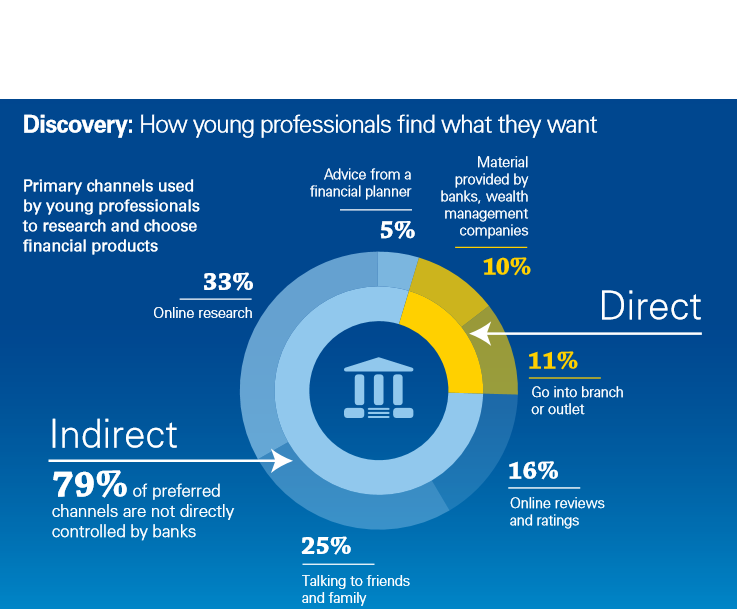

An online survey about the future banking was conducted by Hazel Heartwood (2015) over 300 respondents, most of them are students. It was found that people demand a more transparent banking system. These customers need more information about the way in which their banks make use of their savings so that they are able to take a wise decision about what to do with their funds. Furthermore, customers still want quality and personalized advice, but preferably from friends or family members. A Discovery: How young professionals find what they want in choosing financial products (KPMG, 2016)

A Discovery: How young professionals find what they want in choosing financial products (KPMG, 2016)

How We Helped

In order to find what new value propositions, BINUS Creates conducts business coaches to the bank’s project team using lean methodology and lean canvas by having several iterations in building, learning, and measuring its solution. This methodology is also combine with the design thinking approach. In building the ideas, we assist the bank in doing market research and prototyping until become a minimum viable product (MVP). Secondly, in measuring we assist the back in validating the product: its user experiences and functionalities. Finally, in the third phase we help the bank doing the learning phase through market validation.

Since banking industries always have to comply very detail regulations and systems, BINUS Creates also uses this basic know-how to develop the assessment metric.

| PRODUCT DESIGN

• Using technology • Simplicity • Personalized advice • Fair contract terms • Plain language • Transparent & Non-discriminatory pricing • Gamification approach |

MARKETING AND ADVERTISING

• Accurate information • Trained staff • No misleading advertisements • Digital environment and style • Brand message about company commitment to social value, environment, and community • Multi channel journey including after sales service (i.e. digital branch centre)

|

| GRIEVANCES REDRESSAL

• Easily accessible • Objective timelines for redressal • Information on alternate dispute resolution mechanism

|

AFTER SALES SERVICES

• Continuous support till the expired term • Prompt settlement of disputes

|

Impact

For some reason, finding the top three problems always be the hardest part in the beginning. Once it is revealed, the next challenges are to find the unique value proposition and unfair advantages. After discussing for 1.5 month, the team comes up with three innovations that can serve the targetted market. However, after looking back to the bank current condition, only one idea is picked and a pitch deck is prepared to be presented in front of the bank’s board of management. This includes not only a bunch of ideas, but also a clear and comprehensive financial plan for the next five years.

Comments :